How to Create Sales Order/Invoice

By Bethany Henry on March 22, 2023

BeginnerSummary of Steps

- Select Sales Order from Shortcuts

- Select Add Sales Order

- Fill out pertinent information

- Customer

- Price List

- Item

- Quantity

- If necessary, add Taxes and Credit Card Processing Fees

- Select Save

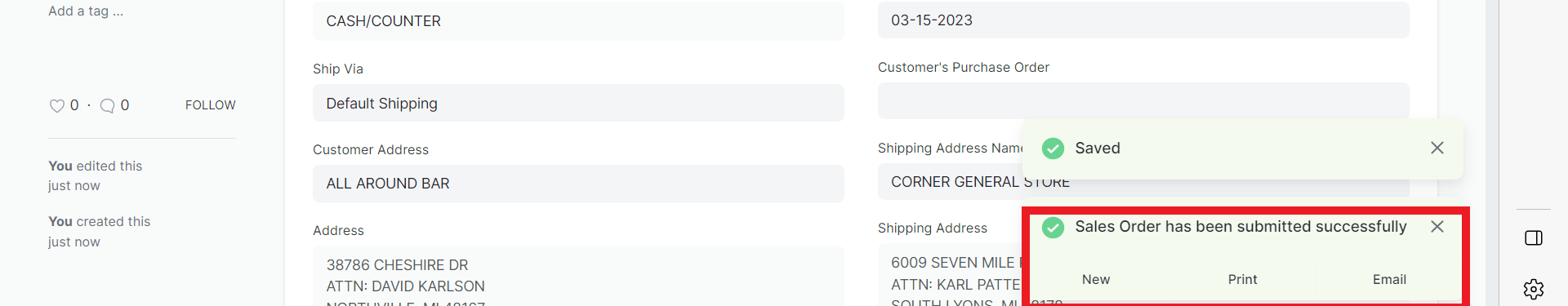

- Select Submit and YES on the pop up to confirm

- A pop up will appear at the bottom of the screen to Print or Email the document. Select if desired. You can also choose to print from the next screen.

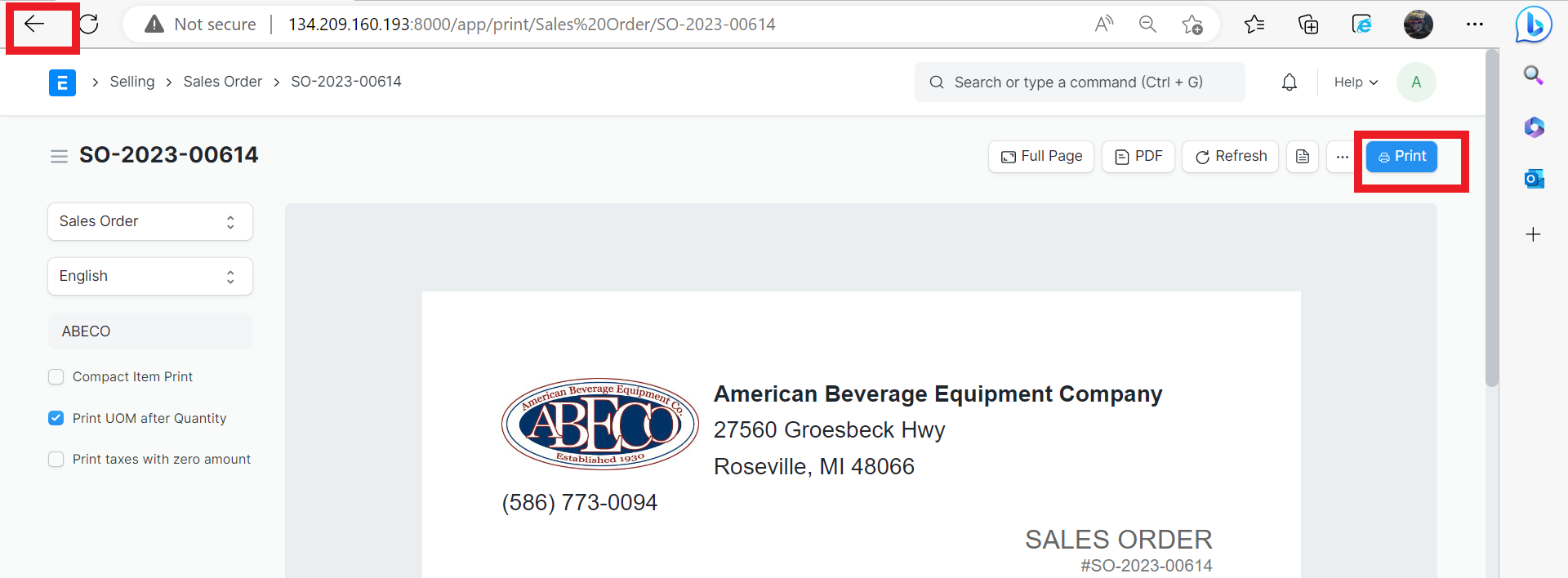

- Print and Select the back arrow to return

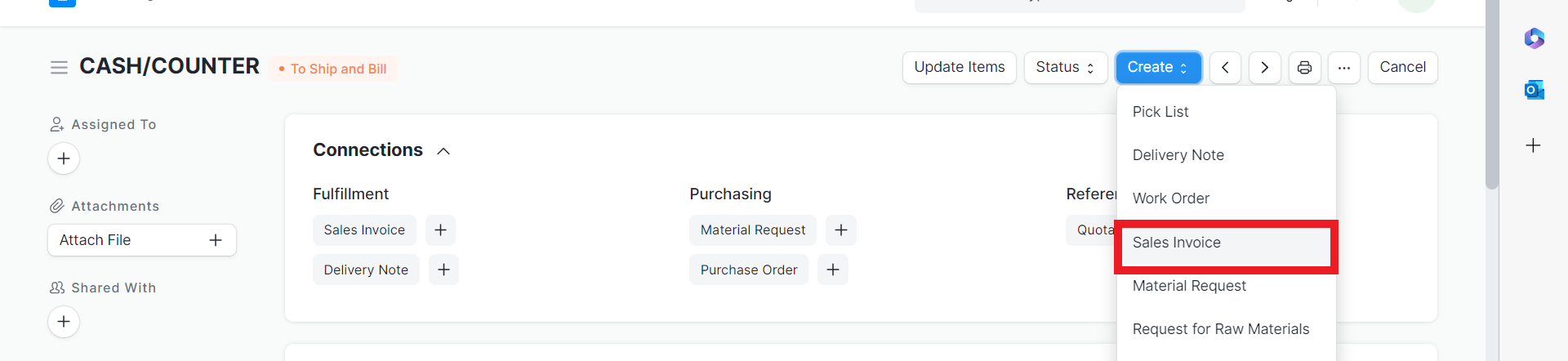

- Select Create and choose Sales Invoice from drop down menu

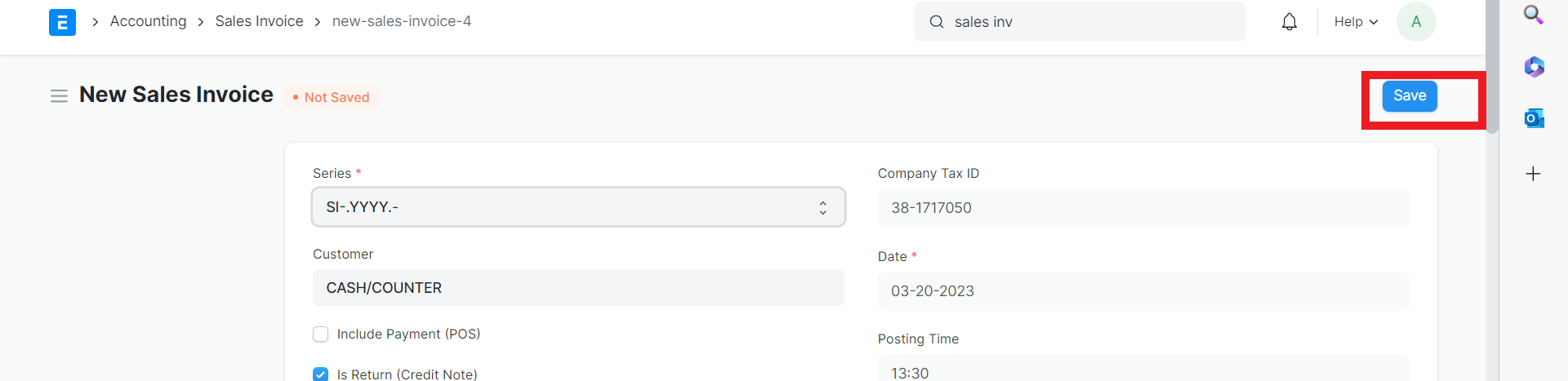

- Select Save

- Select Submit and YES on the pop up to confirm

- A pop up will appear in the bottom right to Print or Email. Choose if desired.

Detailed Steps with Screenshots

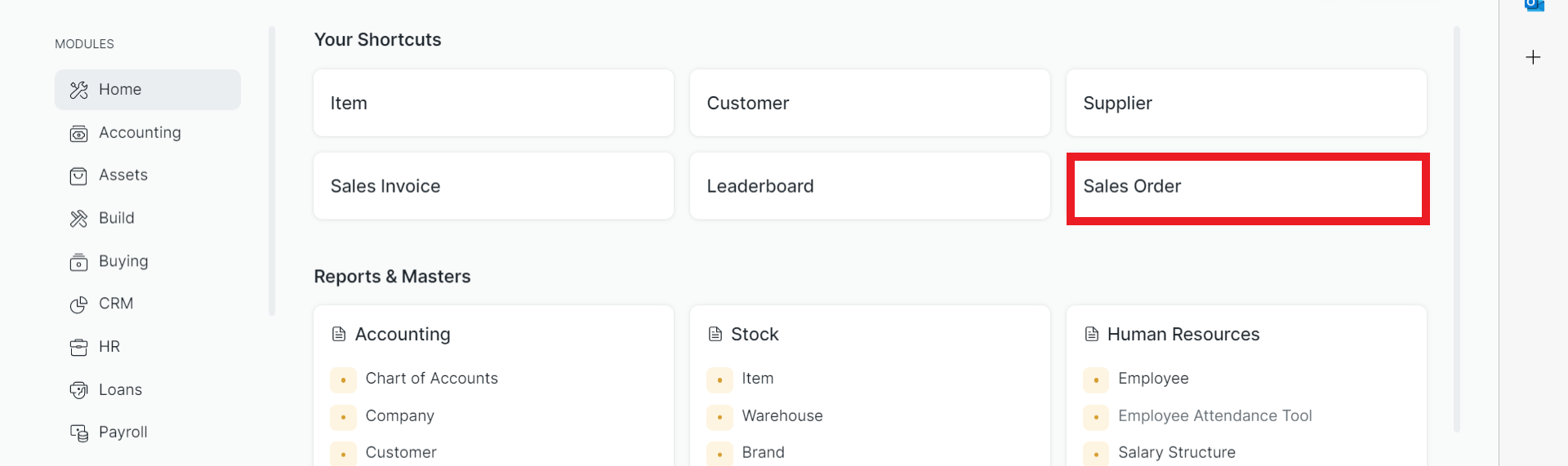

1- Select Sales Order from Shortcuts

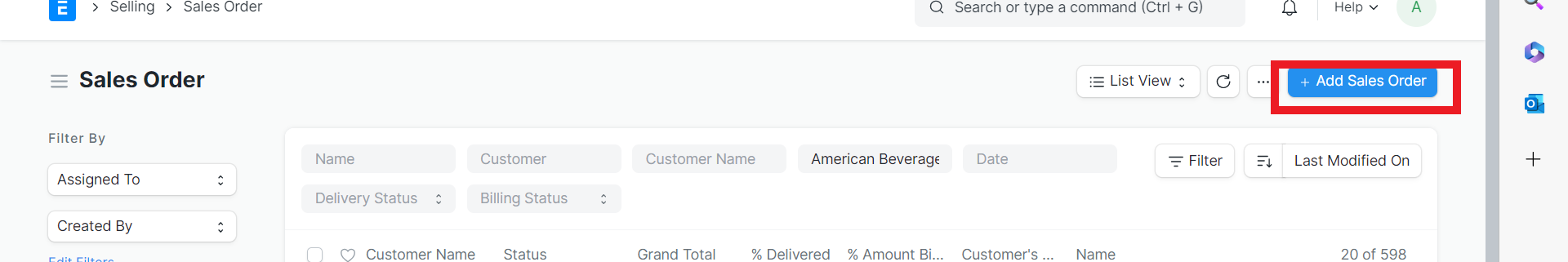

2- Select Add Sales Order

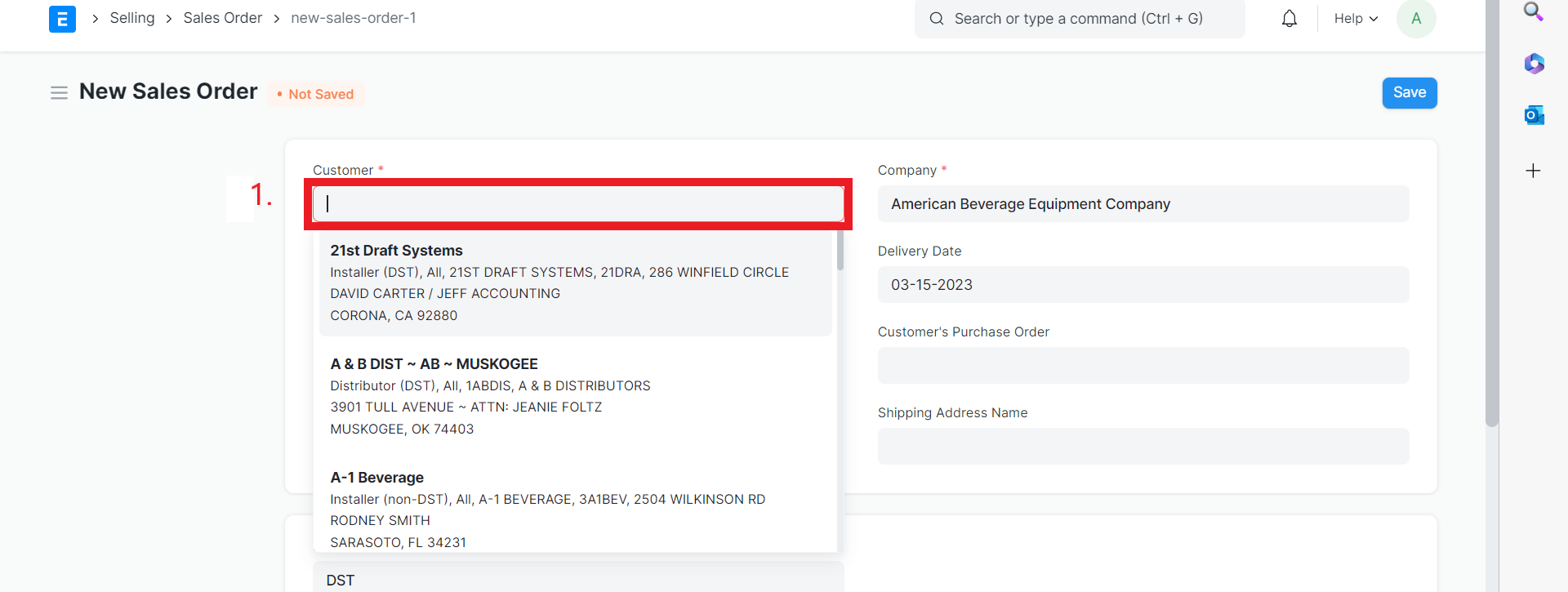

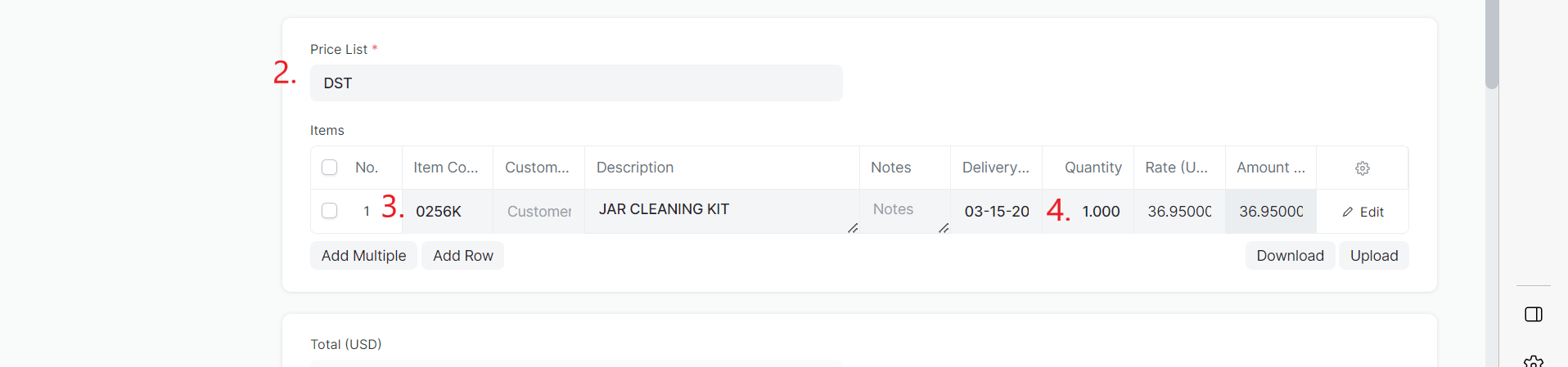

3- Fill out Pertinent Information

- Select Customer from drop down menu

- Make sure correct Price List is chosen

- Select Item from drop down menu

- Enter quantity

Note: You can navigate through the fields using TAB

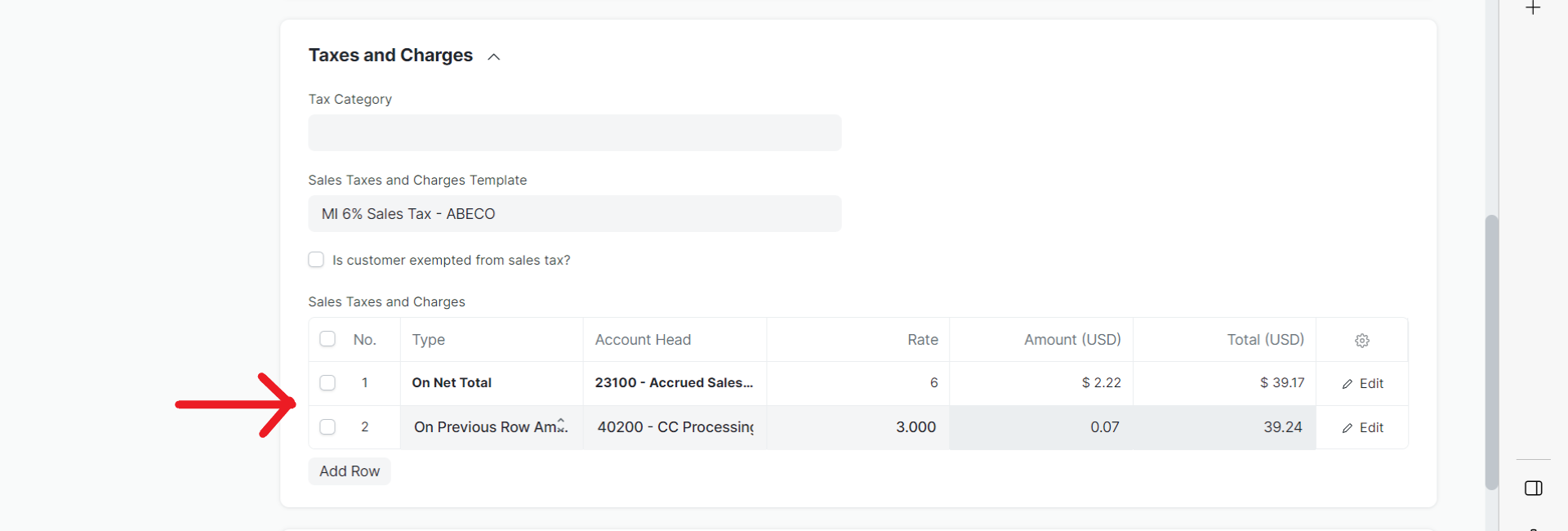

4- If necessary, add Taxes and Credit Card Processing Fees

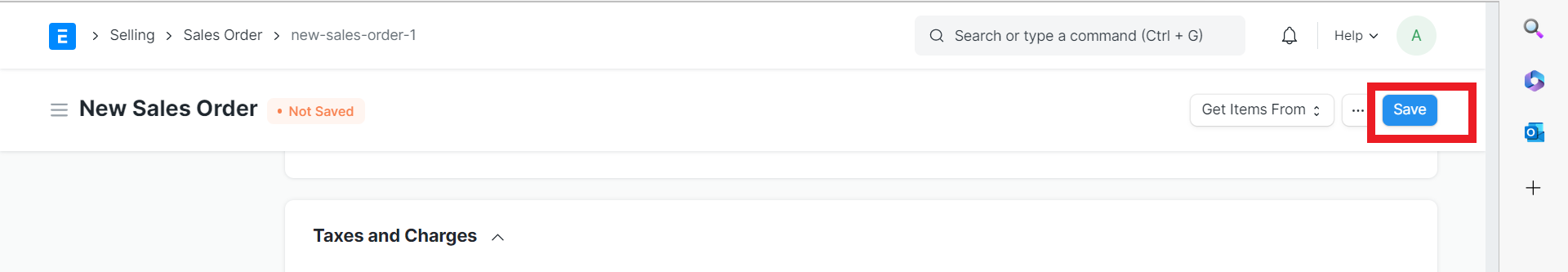

5- Select Save

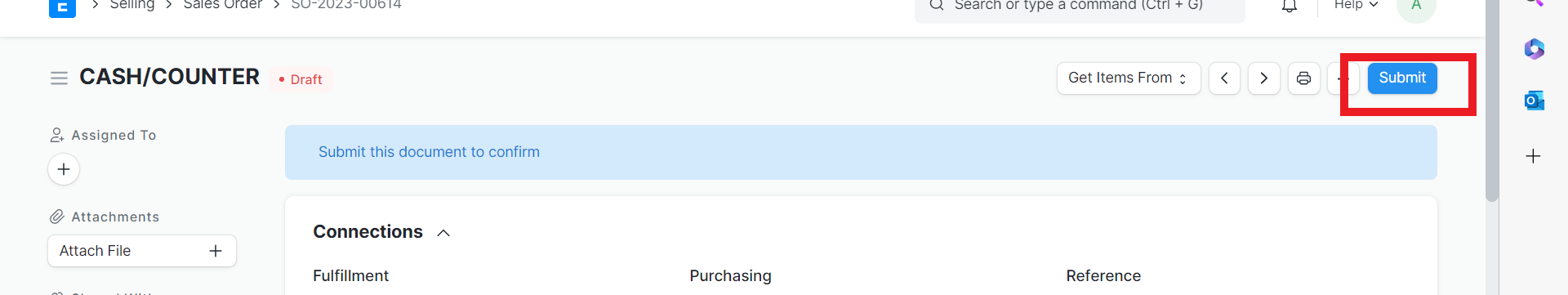

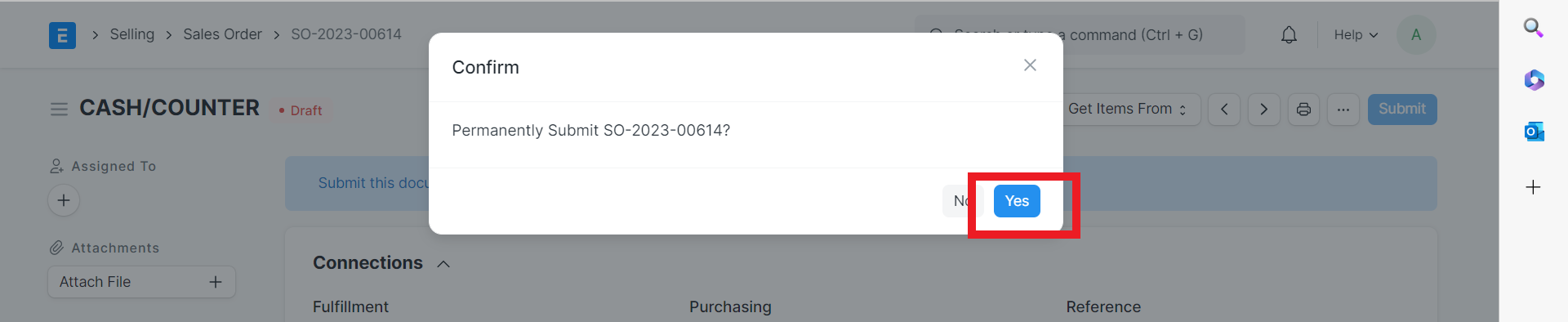

6- Select Submit and YES on the pop up to confirm

7- A pop up will appear at the bottom of the screen to Print or Email the document. Select if desired. You can also choose to print from the next screen.

7a- Print and Select the back arrow to return

8- Select Create and choose Sales Invoice from drop down menu

9- Select Save

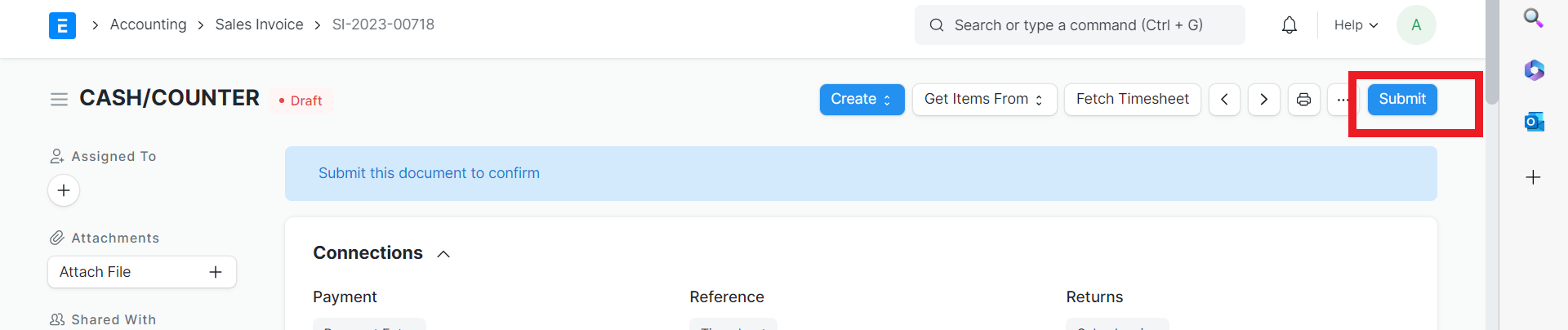

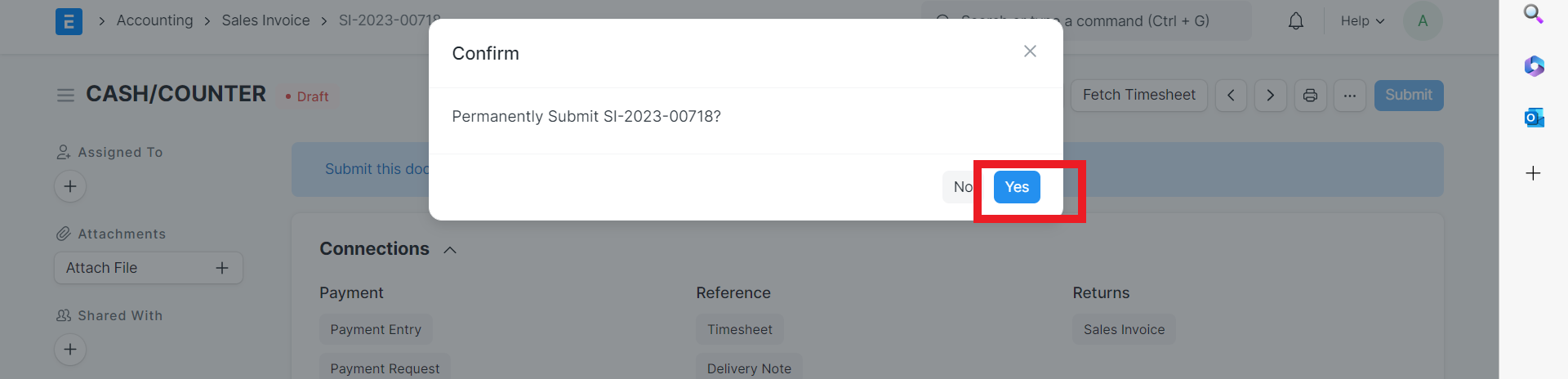

10- Select Submit and YES on the pop up to confirm

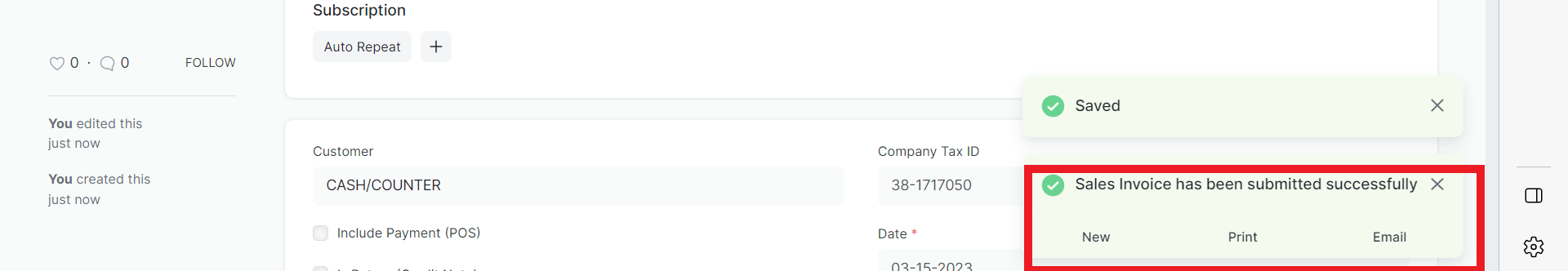

11- A pop up will appear in the bottom right to Print or Email. Choose if desired.

Additional Information

Status Definitions

- Draft: Saved but yet to be submitted

- Submitted: Saved to the system and the general ledger has been updated

- Paid: The customer has made the payment and the Payment Entry has been added to the system

- Unpaid: The invoice has been generated and the customer has not made a payment, but is still within the payment due date

- Overdue: Payment is pending and beyond the due date

- Canceled: Sales invoice is canceled for any reason. Once canceled, any impact on Account and Stock is undone

- Credit Note Issued: Item has been returned and a credit note is created against this invoice

- Return: It is assigned to Credit Note against original invoice

Was this article helpful?

More articles on ABECO Documentation